[ad_1]

Investment Banking: Unlocking Opportunities in the Financial World

Introduction

Investment banking plays a vital role in the global financial landscape. This specialized field brings together capital and businesses, acting as a bridge between investors and corporations. In this article, we will explore the fundamentals of investment banking, its key functions, and the benefits it offers to investors and businesses alike.

What is Investment Banking?

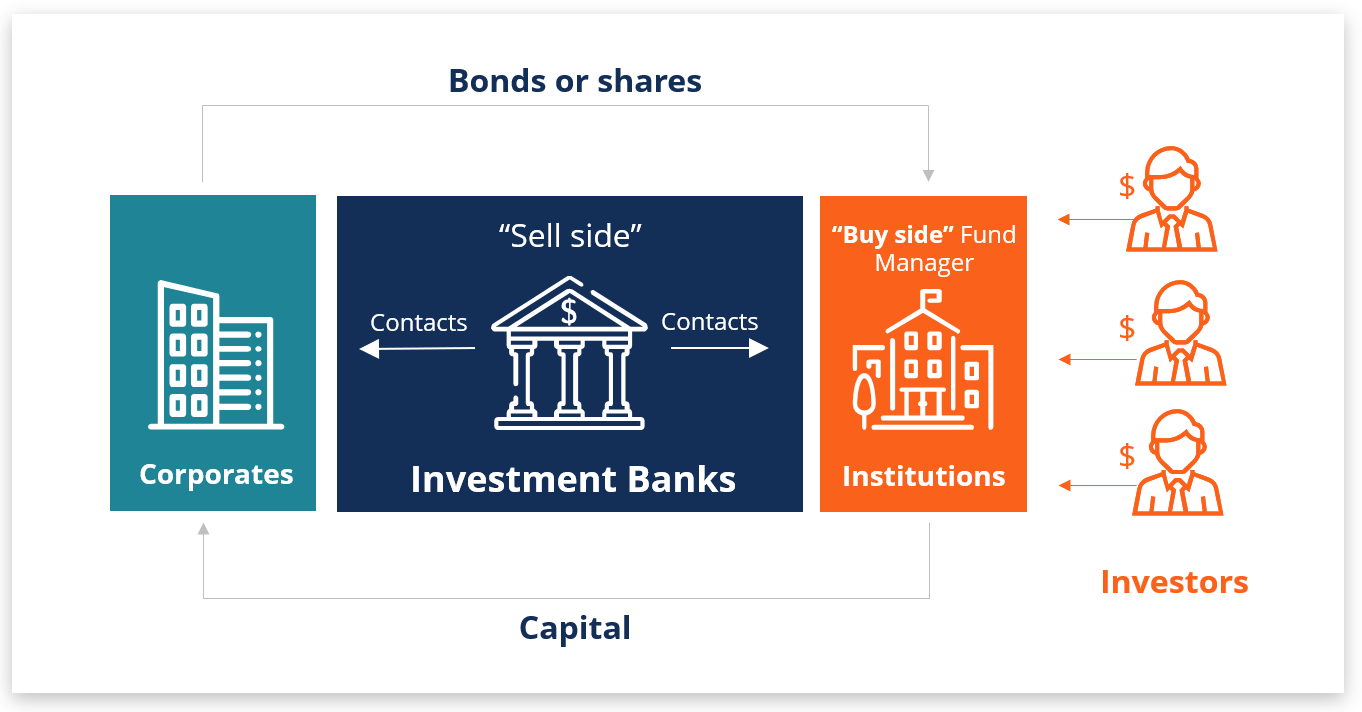

Investment banking involves a range of financial services, primarily focused on raising capital for corporations, advising on mergers and acquisitions, and providing strategic guidance on various financial transactions. Investment bankers act as intermediaries, connecting companies in need of funds with investors seeking lucrative investment opportunities. These professionals possess extensive knowledge of the financial markets, valuation techniques, and regulatory frameworks. They assist in underwriting new securities, issuing stocks and bonds, and structuring complex financial deals.

Key Functions of Investment Banking

- Capital Raising: One of the primary functions of investment banks is to facilitate capital raising for companies. They help businesses issue stocks and bonds to raise funds for expansion, research and development, or other corporate activities. Through initial public offerings (IPOs) or subsequent public offerings, investment bankers enable companies to access the capital markets and attract potential investors.

- Mergers and Acquisitions (M&A): Investment banks play a crucial role in facilitating mergers, acquisitions, and divestitures. They provide advisory services to companies interested in buying or selling businesses, assessing the financial viability of transactions, negotiating deals, and ensuring regulatory compliance. Investment bankers help in valuing businesses, identifying potential synergies, and structuring transactions to maximize shareholder value.

- Corporate Restructuring: During periods of financial distress or strategic repositioning, investment bankers assist companies in restructuring their operations. They devise and execute plans to enhance efficiency, reduce costs, and optimize capital structure. This may involve divestitures, spin-offs, or debt restructuring, enabling businesses to strengthen their financial position and adapt to changing market dynamics.

Benefits of Investment Banking

Investment banking offers numerous advantages to both investors and corporations. For investors, it provides access to a diverse range of investment opportunities. Investment bankers analyze and evaluate investment options, enabling investors to make informed decisions and diversify their portfolios. Furthermore, investment banking services provide liquidity and facilitate trading in the financial markets, allowing investors to buy and sell securities efficiently.

Corporations benefit from investment banking expertise by accessing the capital they need to fuel growth. Investment bankers help businesses raise funds at competitive rates, leveraging their industry knowledge and extensive network of investors. Additionally, investment banks provide valuable strategic advice, helping corporations navigate complex financial transactions and make sound business decisions.

Conclusion

Investment banking serves as a vital catalyst in the global economy, fostering growth and facilitating financial transactions. By bridging the gap between investors and corporations, investment bankers play a critical role in capital raising, mergers and acquisitions, and corporate restructuring. The services provided by investment banks unlock opportunities for investors and businesses, driving economic prosperity.

Related

[ad_2]

Source link