[ad_1]

Transunion dispute Credit TransUnion is one of the three major credit bureaus in the United States, along with Equifax and Experian. Credit bureaus collect and maintain information about consumers’ credit histories, including credit accounts, payments, and balances. This information is used to calculate credit scores, which can have a significant impact on a person’s financial life. However, sometimes the information reported by credit bureaus is incorrect, which can result in a lower credit score and difficulty obtaining credit. This is where the TransUnion dispute process comes in.

What is a TransUnion dispute?

A TransUnion dispute is a process by which a consumer can dispute information that has been reported to TransUnion. If a consumer believes that there is inaccurate information on their TransUnion credit report, they can file a dispute to have the information corrected or removed. This can include incorrect account information, inaccurate payment history, or fraudulent accounts.

Why is it important to dispute inaccurate information on a TransUnion credit report?

Inaccurate information on a credit report can have a significant impact on a person’s financial life. Credit reports are used by lenders, landlords, and other entities to determine a person’s creditworthiness. A lower credit score can result in higher interest rates on loans, difficulty obtaining credit, and even denial of credit or employment opportunities. Disputing inaccurate information on a credit report is important to ensure that a person’s credit score accurately reflects their creditworthiness.

How to file a TransUnion dispute?

Congress members’ personal data exposed in DC Health Link Breach

Filing a TransUnion dispute is a straightforward process that can be done online or by mail. To file a dispute online, consumers can visit the TransUnion website and follow the instructions to initiate a dispute. To file a dispute by mail, consumers can send a letter to TransUnion outlining the inaccurate information and requesting that it be corrected or removed.

When filing a dispute, it is important to provide as much documentation as possible to support the dispute. This can include copies of credit statements, letters from creditors, and other relevant documents. Consumers should also clearly identify the inaccurate information and provide a detailed explanation of why it is inaccurate.

What happens after a TransUnion dispute is filed?

After a TransUnion dispute is filed, TransUnion will investigate the dispute and notify the consumer of the results. If the dispute is found to be valid, TransUnion will update the credit report to reflect the corrected information. If the dispute is found to be invalid, TransUnion will notify the consumer of the decision and provide an explanation.

It is important to note that the TransUnion dispute process can take several weeks or even months to complete. During this time, consumers should continue to monitor their credit reports and ensure that all information is accurate.

What are the potential outcomes of a TransUnion dispute?

The potential outcomes of a TransUnion dispute depend on the specific circumstances of the dispute. If the dispute is found to be valid, the inaccurate information will be corrected or removed from the credit report. This can result in a higher credit score and improved creditworthiness.

If the dispute is found to be invalid, the inaccurate information will remain on the credit report. In this case, consumers can continue to dispute the information or take other steps to improve their credit score, such as paying off debts or increasing their credit limit.

What are some common reasons for filing a TransUnion dispute?

There are many reasons why a consumer might file a TransUnion dispute. Some common reasons include:

- Inaccurate account information: This can include incorrect account balances, payment history, or other details.

- Fraudulent accounts: This can include accounts that were opened fraudulently in the consumer’s name.

- Identity theft: This can include instances where a consumer’s personal information was stolen and used to open fraudulent accounts.

- Mixed credit files: This can occur when a consumer’s credit information is mixed up with

TransUnion Dispute: Understanding the Process and Steps to Take

TransUnion is one of the three major credit reporting agencies in the United States, along with Equifax and Experian. They gather and maintain information on consumers’ credit history and sell this information to lenders, employers, and other interested parties. Unfortunately, errors can occur in credit reports, which can have serious consequences for consumers. Fortunately, the Fair Credit Reporting Act (FCRA) provides a process for disputing errors on credit reports, including those maintained by TransUnion.

The first step in disputing errors on your TransUnion credit report is to obtain a copy of your report. You are entitled to one free copy of your credit report from each of the three major credit reporting agencies every 12 months, which you can obtain through annualcreditreport.com. Once you have your report, review it carefully and look for any errors, such as inaccurate account information, incorrect personal information, or accounts that don’t belong to you.

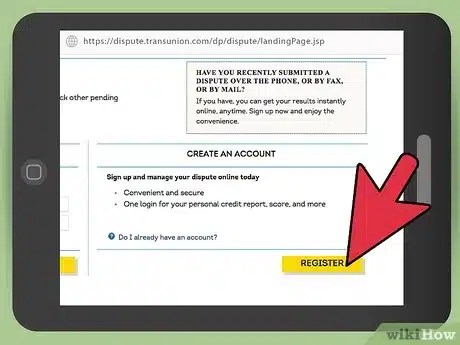

If you find an error on your TransUnion credit report, the next step is to initiate a dispute. You can do this online, by phone, or by mail. To dispute an error online, visit TransUnion’s dispute center and follow the instructions to file a dispute. You’ll need to provide your personal information, the specific error you’re disputing, and any supporting documentation you have. TransUnion will investigate your dispute and notify you of the results within 30 days.

If you prefer to dispute an error by phone, you can call TransUnion’s dispute line at 800-916-8800. A customer service representative will guide you through the process and may request additional information or documentation from you. Like the online dispute process, TransUnion will investigate your dispute and notify you of the results within 30 days.

Finally, if you prefer to dispute an error by mail, you’ll need to write a letter to TransUnion outlining the error you’re disputing and any supporting documentation you have. Mail your letter and documentation to TransUnion at the address listed on your credit report. TransUnion will investigate your dispute and notify you of the results within 30 days.

Regardless of how you initiate a dispute with TransUnion, there are a few things you should keep in mind. First, be as specific as possible when describing the error you’re disputing. Provide dates, account numbers, and any other information that will help TransUnion investigate your dispute. Second, provide any supporting documentation you have, such as receipts, letters, or statements. This will help TransUnion verify the accuracy of your dispute. Finally, be patient. It may take up to 30 days for TransUnion to investigate your dispute and notify you of the results.

Artificial intelligence spurs 62% of carriers to cut staff – survey

If TransUnion investigates your dispute and agrees that an error exists, they will correct the error and send you an updated credit report. They will also notify the other two major credit reporting agencies (Equifax and Experian) of the correction so that they can update your credit reports as well. If TransUnion investigates your dispute and determines that no error exists, they will send you a notification explaining their decision.

In some cases, you may need to take additional steps to resolve a dispute with TransUnion. For example, if TransUnion corrects an error on your credit report but you continue to receive calls or letters from a debt collector regarding the incorrect information, you may need to file a complaint with the Consumer Financial Protection Bureau (CFPB). The CFPB is a government agency that helps consumers resolve disputes with financial companies, including credit reporting agencies and debt collectors.

In conclusion, disputing errors on your TransUnion credit report can be a frustrating and time-consuming process, but it’s important to take action if you find inaccuracies. By reviewing your credit report regularly and initiating disputes as

Related

[ad_2]

Source link